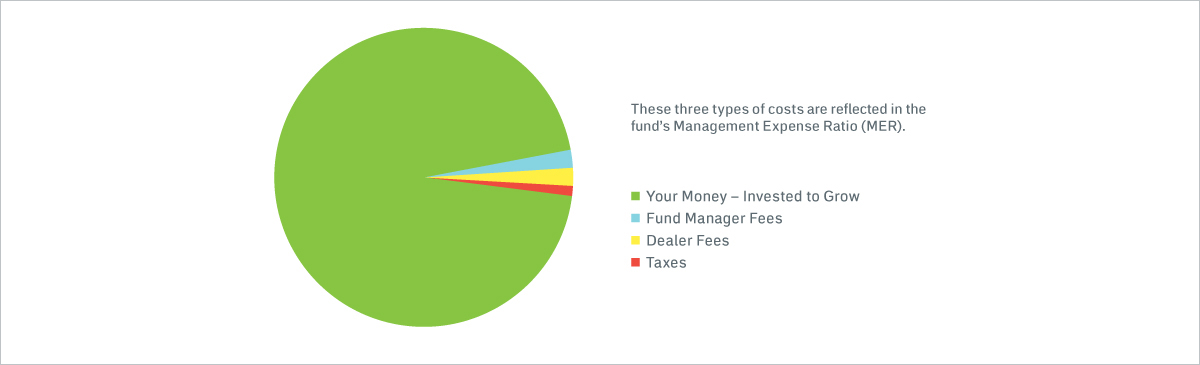

Your fees pay for:

- Services provided by your fund manager – the company that manages the mutual funds that you buy.

- Services provided by your dealer – the firm where your financial advisor is registered, or your discount broker or online investment service.

- Taxes to federal and provincial governments.

A mutual fund’s Management Expense Ratio (MER) is the percent of your investment that your fund manager deducts to pay for these services and taxes. For example, if you invest $10,000 in a fund with an MER of 2.1%, then about $210 of your investment will be used to pay for the costs of your participation in the fund each year.

In Canada, the MER mayy include a payment to the investor’s dealer firm (Item (2) above). Some dealers receive less through the MER but charge a separate fee to investors directly. In these cases, the MER is likely to be lower but you would need to add the dealer or transaction fees to your MER in order to understand your total investment costs.

In 2017, dealers began providing clients with a personalized annual report summarizing the charges and other compensation that the dealer receives in relation to your investment account. This report includes Item (2) above, plus any separate fee that you have been charged (described in the paragraph above), so that you will have a clearer picture of how much your dealer received in relation to your account.